API Integration: The Backbone of Modern Apps Development

In modern app development, API integration is the glue that holds together various components of an application. An API (Application Programming Interface) defines the methods and data formats for communication between software components. This communication can occur between internal modules or with external third-party services.

For instance, a mobile application might display weather information or handle payments through APIs rather than developing those features from scratch. This seamless backend connectivity empowers development teams to build sophisticated, feature-rich applications faster and more efficiently.

Enhancing Functionality and User Experience

APIs significantly boost an application’s capabilities and improve the end-user experience. Rather than creating every feature from the ground up, developers can integrate APIs to add value instantly.

Common API integrations include:

- Payment Gateways: To handle secure and efficient transactions.

- Social Media APIs: For user authentication, sharing, and social login.

- Geolocation and Mapping APIs: To offer navigation, local search, and location-based services.

- Communication APIs: For SMS, push notifications, and email communication.

- Analytics APIs: To track user behavior and app performance.

For example, enabling social login via an API simplifies onboarding, while integrating recommendation engines can personalize user experiences. These integrations enhance app functionality while saving development time and resources.

Driving Performance, Scalability, and Business Value

API integration not only enriches functionality but also promotes modular and scalable architecture. In a microservices-based environment, different parts of the application communicate through APIs. This decoupled design allows front-end and back-end teams to work independently and scale different services as needed.

Such an approach enhances:

- Performance: Individual services can be optimized and scaled independently.

- Flexibility: Teams can experiment and deploy features without impacting the whole system.

- Fault Tolerance: If one API or service fails, others can continue functioning.

From a business perspective, APIs accelerate time-to-market and open up monetization opportunities. Many companies are now generating substantial revenue through API-first products and services. APIs also allow businesses to partner with other platforms, extending their reach and unlocking new customer segments.

Real-World Examples of API Integration

API integration powers some of the most successful digital platforms today:

- Streaming Services: Use internal APIs to handle content delivery, user preferences, and search functionalities.

- Ride-Sharing Apps: Integrate mapping, payment, and messaging APIs to deliver a seamless transportation experience.

- E-Commerce Platforms: Use APIs for payment processing, inventory management, customer reviews, and shipment tracking.

In each case, APIs enable businesses to rapidly innovate, scale, and provide exceptional customer experiences without being bogged down by infrastructure limitations.

Current Trends in API Integration

As the digital ecosystem evolves, several trends are shaping the future of API integration:

- GraphQL Adoption: Unlike traditional REST APIs, GraphQL allows clients to request exactly the data they need, reducing over-fetching and improving performance.

- AI-as-a-Service APIs: Apps are increasingly integrating machine learning features through third-party APIs, such as image recognition or natural language processing.

- Serverless API Models: Serverless computing is enabling dynamic, event-driven APIs without dedicated server infrastructure.

- API-First Design Philosophy: Teams are now designing APIs before building the app, ensuring consistency, reusability, and better documentation.

- Integration Platforms: Tools and platforms dedicated to API management are becoming essential for businesses handling complex integrations and security requirements.

Understanding and leveraging these trends allows developers and product teams to future-proof their applications and stay competitive.

Common Challenges in API Integration

Despite its advantages, integrating APIs also comes with its own set of challenges:

- Security Risks: APIs must be protected against unauthorized access. Developers must use encryption (HTTPS), token-based authentication (OAuth), and input validation.

- Downtime and Reliability: A failure in a third-party API can affect your app. Implementing fallback mechanisms and monitoring systems helps mitigate these risks.

- Latency Issues: External API calls can introduce delays. Caching, rate limiting, and query optimization are essential techniques to maintain speed.

- Versioning and Maintenance: APIs evolve. Using versioned endpoints and adhering to backward-compatible practices ensures smooth transitions when updates occur.

- Inconsistent Standards: Not all APIs are created equal. Differences in data formats, authentication methods, and documentation quality can complicate integration efforts.

Anticipating and preparing for these issues can prevent bottlenecks and ensure your application runs smoothly.

Best Practices for Effective API Integration

To ensure successful API integration, follow these best practices:

1. Design First, Integrate Later

Adopt an API-first development approach. Clearly define the API contract using tools like OpenAPI specifications before you start building features.

2. Use REST or GraphQL Thoughtfully

REST remains the standard for many APIs due to its simplicity, but GraphQL is gaining traction where flexibility and performance are priorities. Choose based on the app’s needs.

3. Prioritize Security

Implement robust security measures:

- HTTPS encryption

- OAuth2 or API key authentication

- Rate limiting

- Input sanitization

- Token expiration policies

4. Monitor and Log Everything

Use logging tools and dashboards to monitor API performance, track failures, and optimize latency. Proper visibility helps you react swiftly to issues.

5. Optimize for Performance

Minimize data payloads by requesting only necessary fields, paginate responses when needed, and use caching to avoid unnecessary calls.

Conclusion

API integration has become a cornerstone of modern apps development. Whether you’re building a mobile game, a SaaS platform, or an enterprise solution, APIs offer the power to expand functionality, accelerate development, and improve scalability — all while lowering costs.

By following best practices and understanding current trends, developers and businesses can fully leverage APIs to deliver exceptional digital experiences. The API economy is growing rapidly, and those who master integration will find themselves at the forefront of innovation.

Submit Your Inquiry

Related Posts

Oct 2025

Key Features Financial Firms Look for in App Developers

The financial sector is evolving faster than ever, and much of this transformation depends on technology. From mobile banking and digital wallets to AI-driven investment platforms, financial institutions now depend on software that is secure, scalable, and intelligent. Behind every successful fintech app is a development team that understands the intricate balance between compliance, innovation, and user trust. Choosing the right app development company has therefore become one of the most critical decisions financial organizations make. Here’s what leading financial services firms prioritize when partnering with app development companies and how generative AI companies are becoming part of this digital transformation. Deep Industry Knowledge and Compliance Expertise Financial services operate under strict regulations. Whether it’s data privacy under GDPR, KYC (Know Your Customer) procedures, or anti-money laundering standards, there is little room for error. Top-tier app development companies that cater to financial clients bring deep industry knowledge to the table. They understand compliance frameworks and integrate them directly into the design and architecture of the app. For example, a firm developing a trading app must not only create an intuitive interface but also ensure that the backend supports transaction logging, audit trails, and user authentication that meet financial-grade security standards. Development teams familiar with financial compliance can anticipate potential risks before they turn into costly problems. This is one reason why experienced fintech developers are in constant demand. Security as a Non-Negotiable Foundation No matter how visually appealing or user-friendly an app is, security remains the cornerstone of financial software. Data breaches can shatter trust instantly, and rebuilding credibility in financial markets takes years. Financial organizations look for app development companies that follow strict security protocols, including: End-to-end encryption for all user data Multi-factor authentication to protect accounts Regular penetration testing and vulnerability scans Secure API integrations with third-party financial systems Beyond basic cybersecurity, top firms implement secure DevOps pipelines where code is continuously tested and monitored. Many generative AI companies are also integrating intelligent threat detection systems that can predict and prevent suspicious activities using machine learning. This fusion of traditional development expertise with AI-driven monitoring has become a major differentiator for app development partners. Scalability for High Transaction Volumes Financial platforms handle enormous data volumes and thousands of simultaneous transactions. Any downtime or lag can result in lost revenue and reputational damage. The best app development companies design architectures that scale effortlessly. They rely on cloud-based microservices, containerized environments, and auto-scaling mechanisms to handle variable demand. Banks, insurance providers, and trading platforms are increasingly turning to development partners that can build scalable solutions with built-in redundancy and disaster recovery options. Generative AI technologies are also finding their way into scalability solutions. By predicting traffic spikes or usage trends, AI can help optimize cloud resource allocation, reducing both operational costs and latency issues. Seamless User Experience with Intelligent Design Financial apps serve users from diverse backgrounds. Some are tech-savvy investors, while others are everyday consumers who want simplicity and clarity. A well-designed app bridges that gap. Leading app development companies focus on user-centric design that simplifies complex financial interactions. They use clear visual hierarchies, easy navigation, and real-time feedback to make users feel confident when managing money online. Now, with the rise of generative AI companies, the user experience is becoming even more intelligent. AI can personalize dashboards, suggest investment strategies, and even explain financial terms in natural language. This fusion of design and intelligence transforms static interfaces into dynamic experiences that adapt to user behavior, enhancing engagement and loyalty. Integration with Legacy and Emerging Systems Financial organizations rarely operate with a clean slate. They depend on legacy infrastructure that handles accounting, compliance, and customer databases. The challenge for development firms is to bridge the old with the new without disrupting operations. Top app development companies specialize in seamless API integrations that allow modern apps to communicate with older systems securely. They understand how to connect traditional banking infrastructure with modern cloud services, blockchain networks, and AI-driven analytics platforms. Meanwhile, generative AI companies are helping automate and simplify these integrations. By using AI to interpret and map legacy data structures, financial institutions can modernize faster while preserving historical data integrity. Focus on Data Analytics and Predictive Insights Data is the most valuable asset in financial services. Every transaction, loan application, or investment activity generates data that can provide valuable insights if analyzed correctly. Modern financial firms expect their app partners to not only build functional software but also to integrate robust analytics tools. This enables real-time decision-making and customer intelligence. Some of the most advanced app development companies now collaborate closely with generative AI companies to implement predictive analytics modules. These systems can detect fraud, assess creditworthiness, and forecast market behavior. When analytics and AI work together, they give financial leaders a clearer view of risks, opportunities, and customer needs. Transparent Development Process and Long-Term Support Financial software requires constant evolution. Regulations change, technologies advance, and user expectations rise. A reliable app development company offers transparency throughout the project lifecycle from ideation and prototyping to deployment and post-launch maintenance. Continuous support ensures that security patches, feature upgrades, and performance improvements happen seamlessly. Many financial firms now prefer partners who provide dedicated account managers, 24/7 monitoring, and proactive updates. As generative AI companies expand their automation capabilities, post-launch support is becoming smarter and faster. Predictive maintenance systems can identify issues before users experience them, reducing downtime and improving reliability. Collaboration Between App Developers and Generative AI Experts The line between traditional software development and AI innovation is fading. Modern financial services demand solutions that are secure, compliant, and intelligent. Many forward-thinking app development companies now partner with generative AI companies to enhance their offerings. Together, they deliver financial solutions that combine human creativity with machine intelligence, apps that not only perform transactions but also understand patterns, anticipate behavior, and learn over time. This collaboration represents the future of fintech development. It allows financial institutions to move beyond static software and toward adaptive, insight-driven digital ecosystems. Final Thoughts Financial institutions today are not just looking for developers. They are seeking strategic technology partners who understand compliance, security, scalability, and intelligence. Whether through a trusted app development company or by leveraging innovations from generative AI companies, the goal remains the same, to create digital experiences that inspire trust, simplify complexity, and keep pace with the evolving financial landscape. In this race toward digital maturity, the firms that combine precision engineering with intelligent automation will define the next era of finance.

Sep 2025

Offshoring for AI App Development: Why It’s Booming Among U.S. Companies

AI has become less of a question of ‘if’ and more of ‘how fast,’ as U.S. enterprises embed it into their core functions. Healthcare systems are deploying predictive analytics for earlier and more accurate diagnoses, financial institutions are strengthening fraud detection through machine learning, and retailers are reshaping customer engagement with AI-driven personalization. McKinsey reports that more than half of U.S. companies now use AI in at least one business function, and adoption continues to accelerate across sectors. Yet this momentum comes with a constraint: the supply of skilled professionals is not keeping pace. The World Economic Forum projects a shortfall of more than one million AI specialists by 2030, while senior engineers in the U.S. already command salaries above $300,000 annually. This imbalance between ambition and capability has created structural bottlenecks, forcing executives to reconsider conventional hiring strategies and turn toward global talent partnerships as a pathway to scale. Source: World Economic Forum, Future of Jobs Report (Talent Gap Projection, 2023–2030) Why Global AI Teams Are Becoming Strategic Offshore development has matured from a cost-saving exercise into a strategic enabler of innovation. Companies like Microsoft and Tesla exemplify this shift. Microsoft continues to expand its AI programs through global partnerships while maintaining strategic oversight domestically. Tesla leverages distributed teams for autonomous vehicle development, combining in-house innovation with international expertise to drive innovation. The rationale is clear: offshore partnerships provide access to scarce talent, accelerate time-to-market, and deliver specialized capabilities. Round-the-clock development cycles shorten delivery timelines, while niche skills in generative AI, natural language processing, and predictive analytics are often more accessible offshore than in U.S. markets. The Core Benefits Executives highlight three advantages that make offshore AI partnerships increasingly attractive: access to global talent, accelerated development, and operational flexibility. 1. Access to Global TalentCountries such as India and Poland are producing highly skilled engineers at scale. India graduates more than 200,000 engineers annually with specialization in AI and data science, while Poland hosts over 250 AI firms with strong expertise in computer vision and NLP. Offshore partnerships give companies immediate access to talent pools that would take years to cultivate domestically. 2. Accelerated Development VelocitySpeed defines competitive advantage in AI. Offshore teams enable continuous progress across time zones, compressing development cycles significantly. A Fortune 500 financial services company, for example, brought a fraud detection solution to market two months ahead of schedule by leveraging offshore AI specialists, a window that proved decisive in a competitive segment. 3. Operational Flexibility AI projects rarely require fixed resources. Early prototyping demands small, specialized teams, while large-scale deployments call for broader engineering groups. Offshore models allow companies to scale resources up or down seamlessly, aligning investment with project needs rather than permanent headcount. Managing Risks Through Structure Concerns about data security, compliance, and collaboration are common but increasingly manageable with the right frameworks. Leading offshore providers operate within GDPR, HIPAA, and SOC 2 standards as a baseline. Secure environments, end-to-end encryption, and robust IP agreements ensure sensitive datasets remain protected. Effective communication frameworks are equally important. Hybrid sprint models, structured overlap hours, and transparent documentation help teams maintain alignment despite geographic distribution. Cultural integration strategies, from orientation programs to shared communication protocols, transform potential friction into operational rhythm. In one healthcare case, offshore collaboration enabled a predictive analytics platform to be developed within strict HIPAA guidelines. Strong governance, secure architectures, and clear accountability allowed innovation without regulatory compromise. Market Dynamics and Future Outlook The offshore AI development market is forecast to grow at a 25% compound annual rate between 2025 and 2030. This trajectory reflects a broader recognition: AI is not a generalist function but a highly specialized discipline requiring distributed expertise. Enterprises are moving toward long-term alliances with offshore providers who understand not only technical requirements but also industry regulations and business goals. Edge AI, multimodal systems, and quantum machine learning demand skills rarely concentrated in one market. Accessing global talent is becoming essential for staying competitive. Strategic Considerations for Executives For business leaders evaluating offshore AI development, four factors are critical. Partner selection should prioritize proven expertise, compliance credentials, and operational maturity. Governance structures must define clear decision rights, communication channels, and escalation protocols. Integration planning is essential — investing in onboarding, knowledge transfer, and relationship building avoids misalignment. Risk management should cover IP protection, security audits, and contingency planning to ensure resilience. The Competitive Imperative The AI talent gap shows no sign of easing before 2027, meaning competition for scarce domestic resources will remain intense. Meanwhile, the global AI market is projected to grow from $251.7 billion this year to $338.9 billion next year — a 34.7% surge. Companies unable to move at speed risk falling behind as markets consolidate around faster, more agile competitors. Forward-looking executives increasingly recognize offshore AI partnerships not as tactical stopgaps but as strategic accelerators. These partnerships deliver the talent, velocity, and flexibility required to lead in a field where innovation cycles are measured in months, not years. Conclusion In my experience working with global enterprises, the organizations that succeed with AI are those that treat offshore partnerships as a strategic capability rather than a cost lever. The ability to access specialized expertise, scale teams with precision, and maintain development momentum across time zones often determines whether initiatives move from pilot to impact. What I see across industries is clear: companies that invest early in building trusted global alliances are better positioned to turn ambition into execution. AI innovation depends not only on technology but also on the strength of the ecosystems we build around it. The leaders who recognize this and act decisively will shape the next decade of AI-driven growth.

May 2025

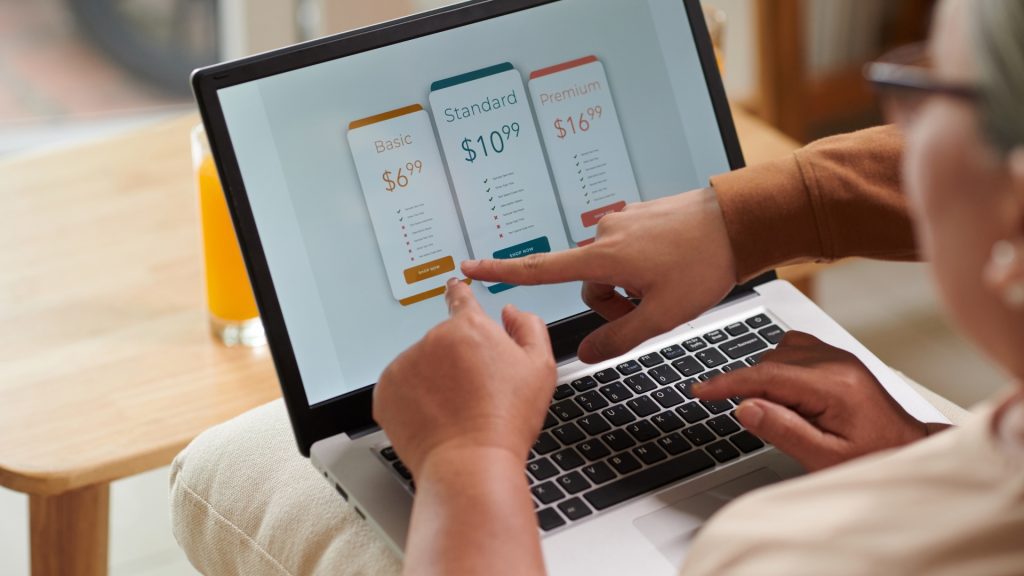

The Rise of Subscription-Based App Models

Introduction: A Shift in the App Economy The mobile app economy has witnessed a seismic shift from one-time purchases and ad-driven models to subscription-based monetization. This transition has not only redefined how apps generate revenue but also how they maintain user engagement and long-term value. For mobile app developers and companies offering on-demand app development, this model presents both an opportunity and a challenge. In this blog, we explore the rise of subscription-based app models, the driving factors behind their popularity, benefits for businesses, and how they shape the future of monetization and user retention. Understanding Subscription-Based App Models A subscription-based app offers users access to premium content or features for a recurring fee—monthly, quarterly, or annually. This model is commonly seen in streaming apps, fitness platforms, cloud-based tools, and even productivity or educational apps. What sets it apart from traditional app monetization models? Recurring Revenue: Predictable income stream over time. Continuous Engagement: Incentivizes app developers to keep the user experience fresh and valuable. Scalability: As more users subscribe, growth compounds without proportionally increasing costs. Why Are Subscriptions Gaining Popularity? 1. Changing Consumer Preferences Modern users prefer flexibility. Subscriptions allow access to features without large upfront payments, which is especially attractive in competitive markets where users want to test value before committing. 2. Value Over Time Instead of providing one-time features, app developers now focus on delivering ongoing value—be it updated content, new features, or premium support. 3. Sustainable Revenue Model Unlike ad-driven apps that rely on large user bases and constant traffic, subscriptions create steady recurring revenue, which helps fund development, customer support, and marketing. The Role of Mobile App Developers For mobile app developers, transitioning to a subscription model demands a shift in development priorities: User-Centric Design: Building intuitive interfaces and frictionless onboarding processes to reduce churn. Feature Segmentation: Carefully choosing what to offer for free and what to lock behind a paywall. Data Analytics: Leveraging usage data to personalize experiences and encourage renewals. Successful implementation hinges on aligning technical execution with business strategy. On-Demand App Development & Subscription Models On-demand apps—like food delivery, fitness coaching, digital marketplaces, and remote learning—are increasingly using subscriptions to monetize convenience and exclusive features. Examples: Health & Wellness Apps like Calm and MyFitnessPal offer guided meditations and custom workout plans via subscription. On-Demand Learning Platforms like Duolingo or MasterClass use tiered subscription plans to provide additional content. Utility Apps like cloud storage, VPNs, or note-taking tools offer recurring plans for extra storage or cross-platform sync. For businesses considering on-demand app development, integrating a subscription model can enhance user engagement while stabilizing cash flow. Monetization Strategies Within Subscriptions Developers must choose the right monetization path to balance user satisfaction and profitability. Key strategies include: 1. Freemium Model Offer a basic version for free and encourage users to upgrade for premium features. 2. Tiered Pricing Different subscription levels offer varying degrees of access or features, allowing users to choose based on their needs. 3. Free Trials Let users explore premium features for a limited period. If the app provides genuine value, many convert to paying customers. 4. Loyalty-Based Discounts Offer pricing benefits for long-term users to reduce churn and increase retention. Enhancing User Engagement and Retention With user engagement as the cornerstone of subscription success, here are tactics app developers should adopt: Push Notifications: Remind users of benefits, new content, or time-sensitive features. Personalization: Use AI and behavior tracking to tailor content and offers. Regular Updates: Keep the app fresh with improvements, seasonal content, or new capabilities. Gamification: Use points, badges, or challenges to create stickiness and reward active usage. The goal is to create a habit-forming experience where users see consistent value in maintaining their subscription. Challenges of Subscription-Based Models While the benefits are compelling, there are also hurdles: 1. User Fatigue With every service moving to subscriptions, users may feel overwhelmed. Apps must stand out and prove continuous worth. 2. High Churn Rate If users don’t see value quickly, they cancel. Strong onboarding and immediate benefits are crucial. 3. Technical Complexity Managing payments, renewals, and pricing across regions adds technical and compliance complexity—something experienced mobile app developers need to address during the planning stage. 4. App Store Fees Platforms like Apple and Google take up to 30% of subscription revenue. Developers must factor this into pricing models and margins. Industry Insights and Trends Apple's App Store revenue from subscriptions reached over $23 billion in 2023, showcasing the scale of this model. B2B SaaS apps on mobile are also exploring mobile-first subscriptions, driven by remote and hybrid work models. AI integration in subscription apps is increasing, enabling smarter personalization and automation of content delivery. These trends indicate that the future of mobile apps is increasingly tied to ongoing service rather than one-time value. Future of Subscription Apps: What’s Next? Micro-Subscriptions: Affordable plans for niche features or seasonal access. Bundled Services: Partnerships between apps to offer value bundles (e.g., fitness + diet plans). Dynamic Pricing: AI-based pricing that adjusts based on usage, engagement, or user profile. Greater Transparency: Regulations may push for clearer terms, auto-renewal alerts, and easier cancellation policies. Developers and businesses embracing these trends will be best positioned for long-term growth. Conclusion The rise of subscription-based app models marks a pivotal evolution in how apps are built, marketed, and monetized. For mobile app developers and businesses investing in on-demand app development, this model provides a path toward sustainable revenue and deeper user engagement. However, success lies in understanding user expectations, building value-rich features, and delivering consistent updates that justify recurring payments. By aligning monetization strategies with real user needs, subscription-based models can become the cornerstone of a profitable and enduring app business.